How to track this important margin more efficiently and effectively

My company has been managing profitable hedging strategies around fixed and capped programs since 1993. These forward sales programs, as I call them, are a valuable tool in oil companies’ repertoire for retaining customers. Like farmers planting a crop every season and hedging the profits on the yield of that crop year after year, this hedging practice has become routine for our clients. That said, we still craft a very methodical process around the procurement and placement of the hedges, making sure we reach the target margin for these sales. As with hedging crops, there are subtle nuances that can have a huge impact to the bottom line if ignored.

What baffles me, however, is the haphazard approach that many dealers adopt when managing their daily rack to retail margins. This critical piece of their business is typically a much larger share of their volume than the forward programs these days, and yet they don’t give it the same attention to detail. At Hedge we often spend more time and effort on the rack-to-retail buying strategies than we do on forward sales.

Here, too, there are subtle and not so subtle nuances that can have a significant impact to your bottom line, both positive and negative. Consider the thought process that drives your daily or long-term purchasing decisions for oil. What criteria do you use when choosing to buy from a certain wholesale supplier? Is it location? Is it driver preference? (Please say “NO!”) How about factors like basis and “carry” economics? Have you ever looked at index-based pricing and supply contracts? Do you hedge short-term margin fluctuations? Do you track your margins on a granular level? (I mean literally track your cost to retail mark-up every day.)

Let’s take a look at ways you can unlock increased profitability by improving the way in which you buy your oil both short-term and long-term.

You can control your costs short-term and actually take advantage of market volatility while avoiding the race to the terminal. It is common practice today for wholesalers to offer online ordering and centralized trading desks that help them “lock up” gallons to hedge their profits more efficiently. These so-called portals provide a tool that enables you to lock in your price and hence mitigate your exposure to margin erosion from sudden price spikes. You can hedge these “bulk” purchases for a small premium short-term. You can also lock in that same margin using a paper strategy, allowing you to purchase oil at the rack that may have a better basis than the bulk.

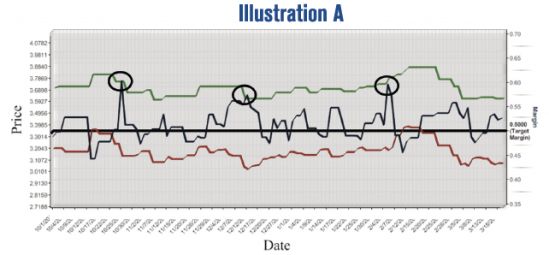

We have our clients track their retail margins daily. Computer generated “dashboards” are a commonly used tool to display this information and reveal critical data every day, allowing clients to be more proactive in managing their businesses. MarginTrak, which we developed several years ago, allows clients to track margins, lets them view how the price action at the rack is impacting that margin, and provides a visual that they can react to quickly (see illustration A).

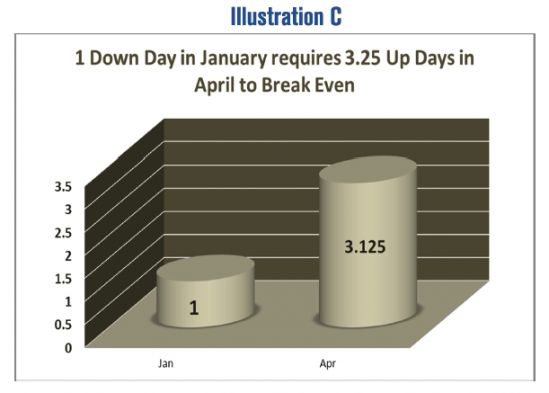

In the heating oil industry, 80 percent of degree days occur in less than six months.

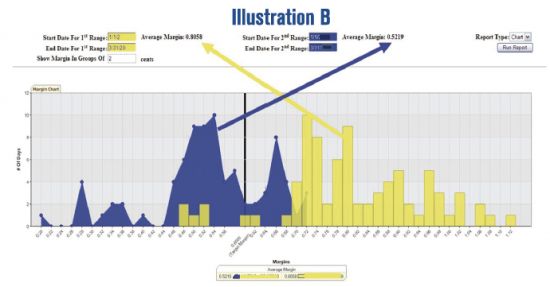

That’s why you should “day count” your margins. My favorite report in MarginTrak is a basic histogram that provides a view of this very important data (see illustration B). How many days in the heating season are spent above or below your target margin? Our clients laud this practice of day counting margins. It motivates them to keep that daily retail price in check longer than they normally would without this critical visual. Because of the natural degree day curve inherent in our business model, for every day in January that you miss your target margin, you need three days in April to recover (see illustration C).

Another reason to monitor and track this valuable metric: visual data also helps you recognize the short-term dynamics that impact your margins. Sudden price spikes typically erode retail margins while sudden decreases in the price often result in the expansion of margins. Most of you are aware of this intuitively, but the visuals confirm what you are thinking. These graphics will motivate you to take action when your margins are exceptional or above your target level, rather than letting the opportunities pass you by.

Making long-term buying decisions today can also benefit you.

Your suppliers have to battle the daily volatility of the market in order to provide product at their racks throughout the year, and at a competitive price. This task has become increasingly more complex in recent times. Storage is demanding a premium, reducing the incentive to offer thru-puts to potential competitors. The result is fewer wholesale suppliers in the market. Faced with this challenging supply environment, many oil distributors are considering the merits of buying some portion of their product through indexed supply agreements, such as Platts- or OPIS-based pricing contracts. Some supply deals allow you to buy oil in a fashion similar to the way wholesale suppliers buy their product. When properly structured, these agreements can result in lower product costs without the distractions that keep many retailers from finding adequate time to run their business and grow their account base. The allure for the supplier is forecasting efficiency with predictable volume and less time spent trying to “win” your business every day.

By looking at just a few key indicators and understanding basis, as well as what is going on with your supplier portfolio, you could impact your procurement costs much more efficiently than by chasing the cheapest rack every day.

We’re always happy to help. Please feel free to contact me with any questions at rlarkin@hedgesolutions.com. You can also visit us online at hedgesolutions.com.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.